Ethical banks: resilient even in the first year of the pandemic

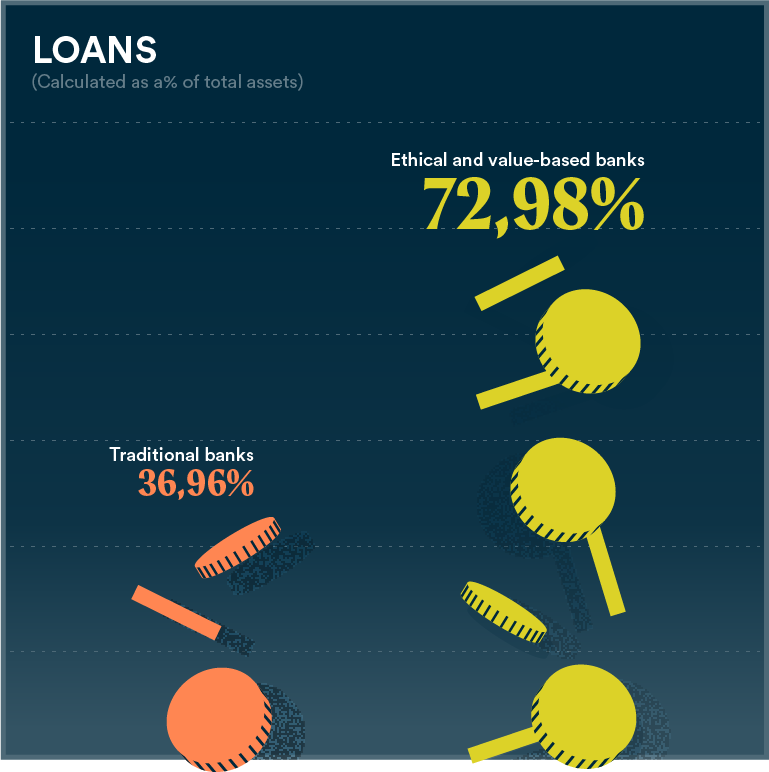

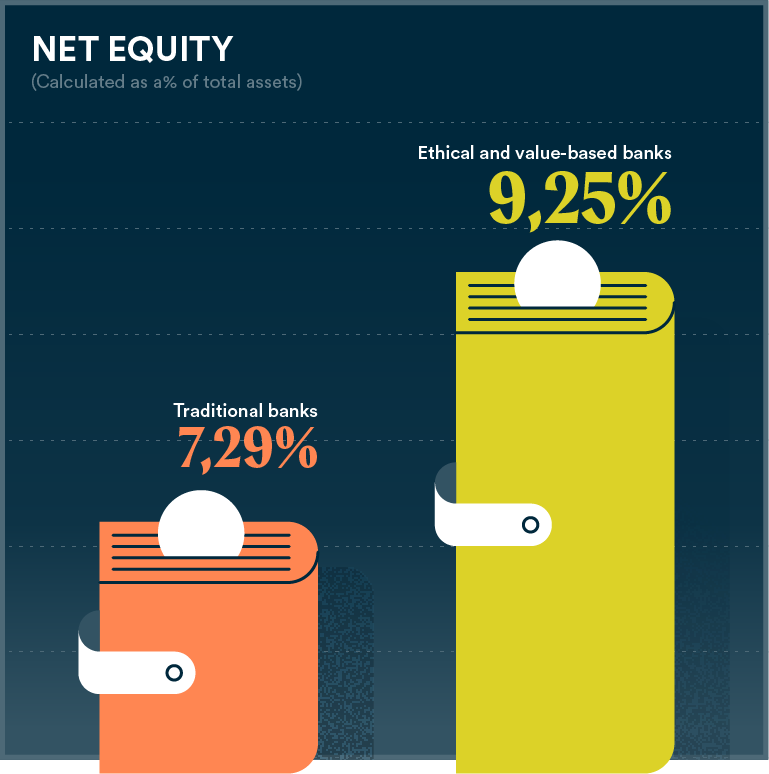

Even in 2020, ethical banks proved to be much more focused on providing services to the real economy than traditional banks. As well as being more profitable on average.

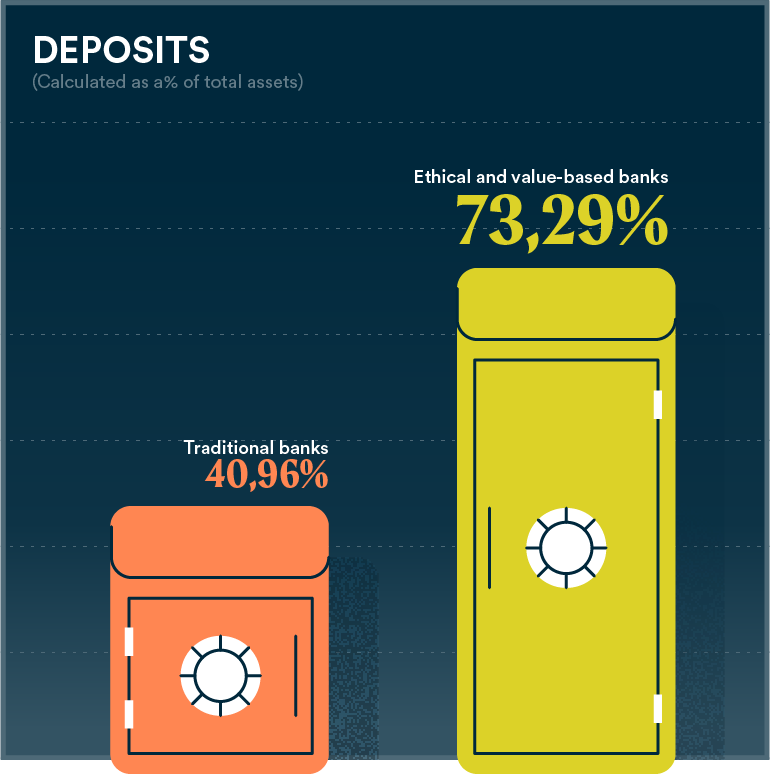

The European banking system as a whole turned out to be resilient in 2020, in stark contrast to the 2008 crisis. The trend in deposits through 2020 seems to have been in uenced positively by the pandemic, which led to a decrease in consumption and an increase in savings. Thus, the volume of bank deposits increased. This trend seems to have been more beneficial for ethical and value-based banks than for the European banking system as a whole.